Skip to main contentOverview

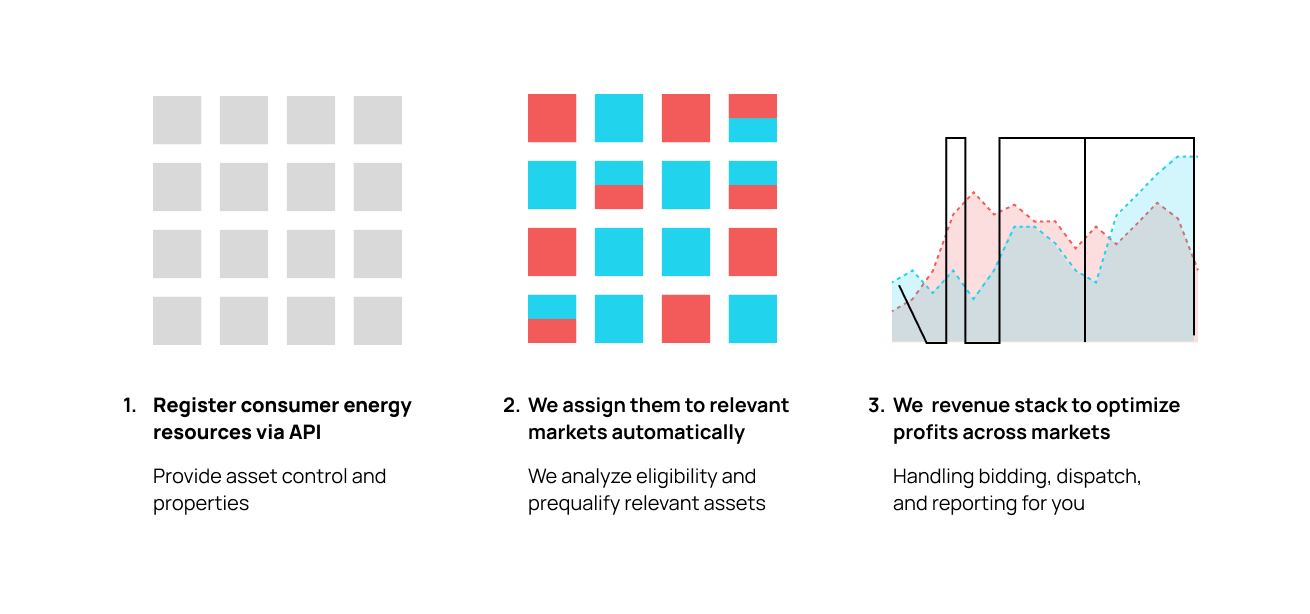

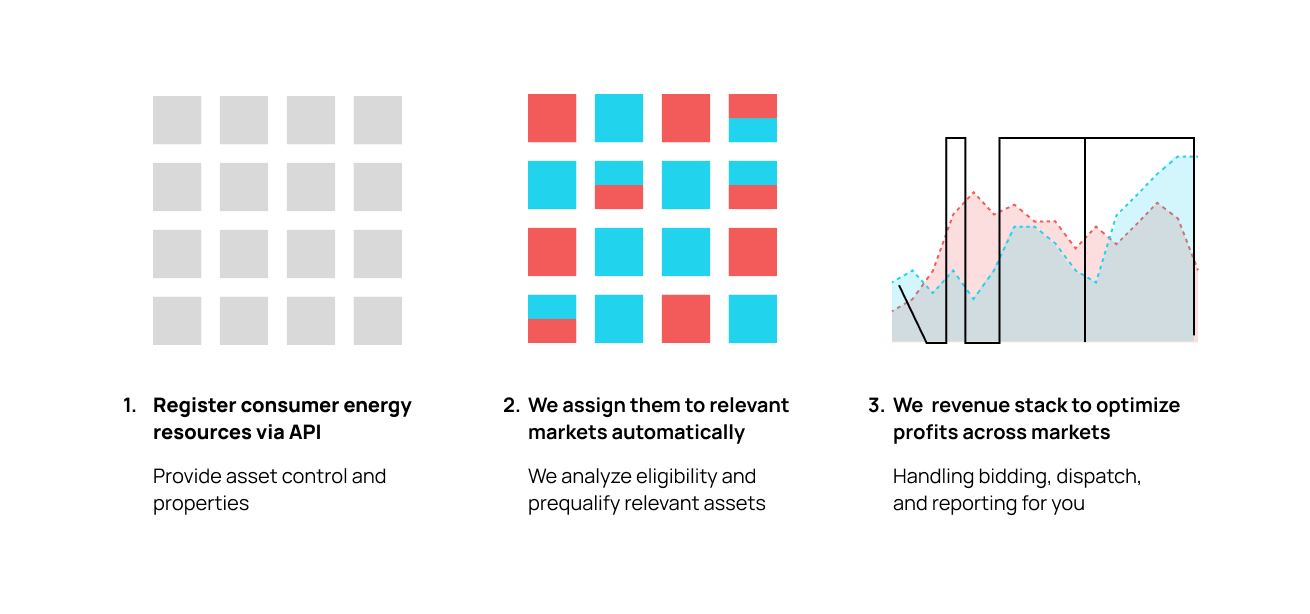

Axle provides a set of APIs to make it easy to register assets, prequalify them,

and take them to market.

Axle provides a set of APIs to make it easy to register assets, prequalify them,

and take them to market.

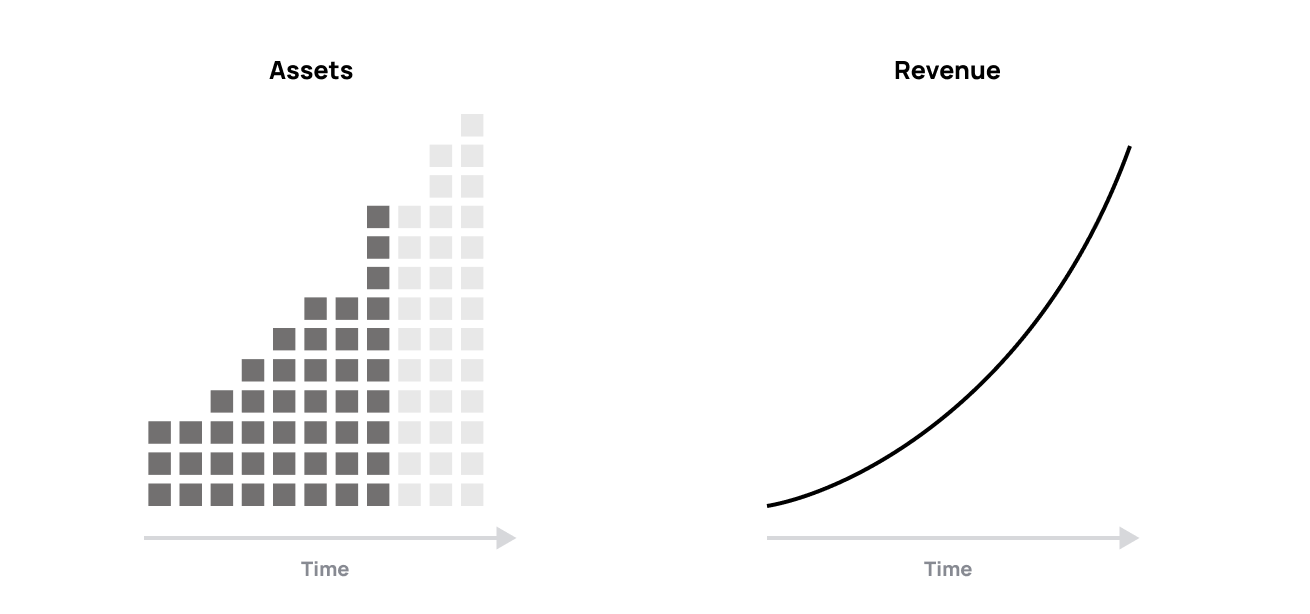

Registering assets

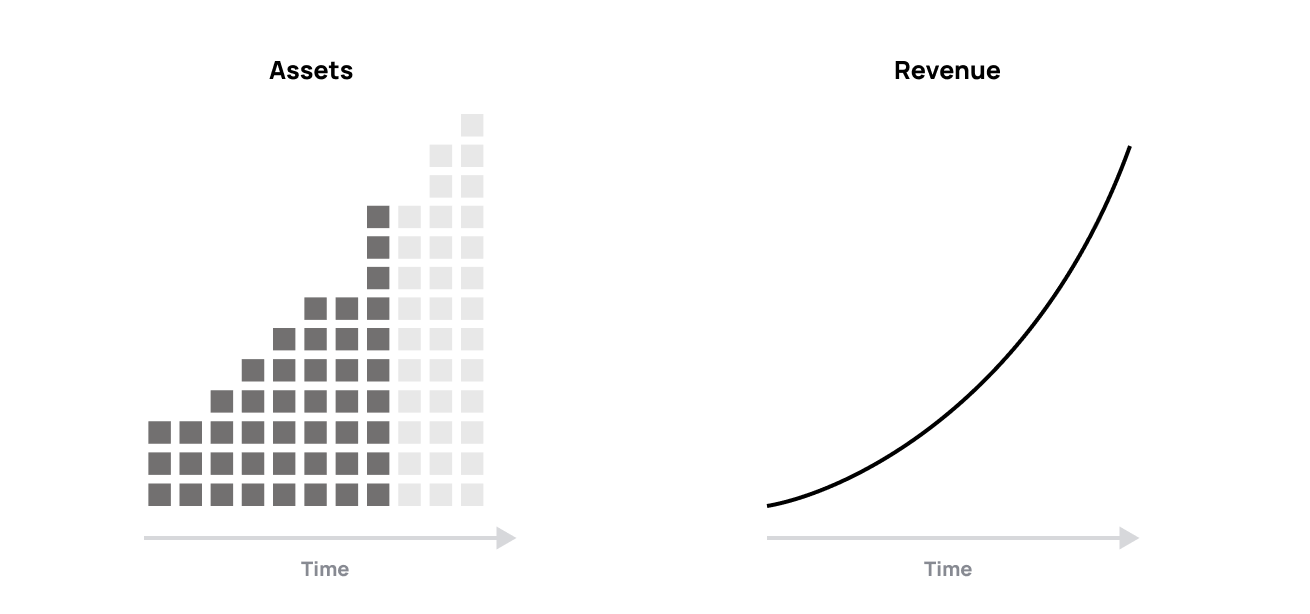

Unlike a traditional aggregator, axle provides incremental market access. This means that you

can continuously add assets over time, as your portfolio of distributed electricified assets grows.

Wholesale optimization

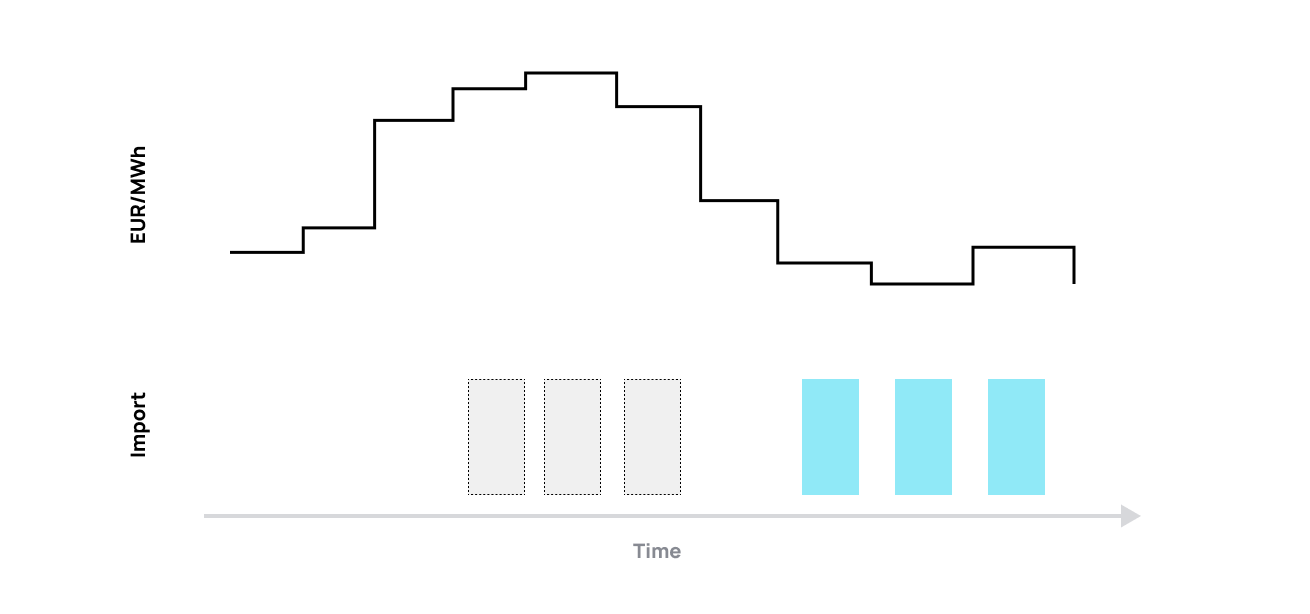

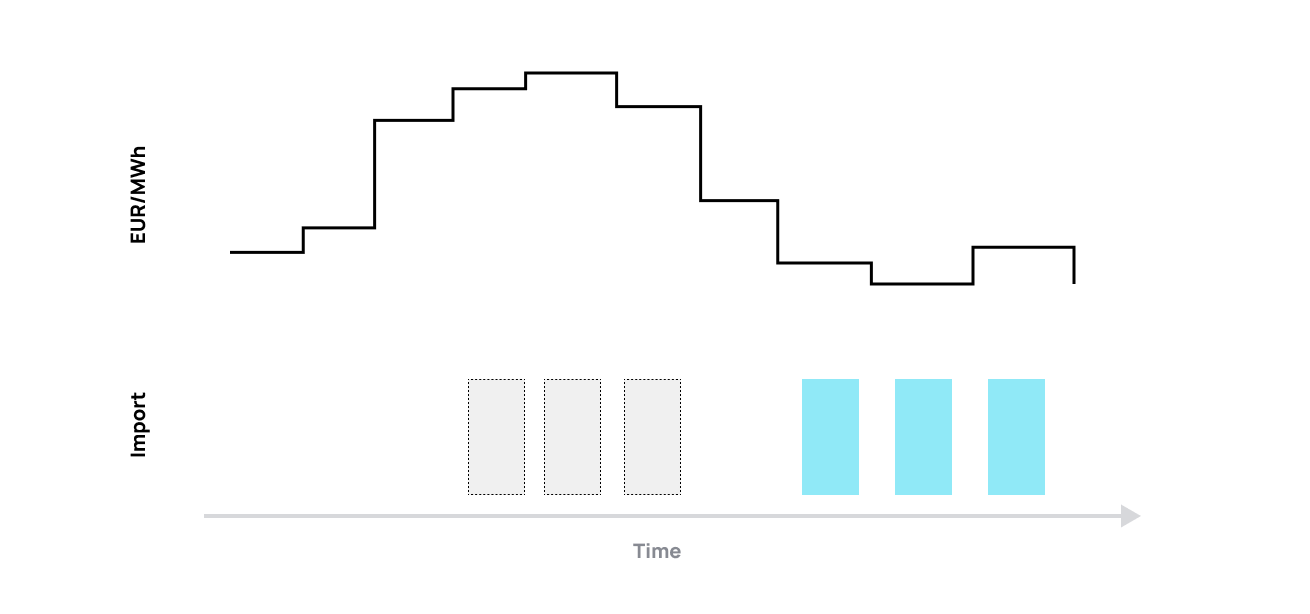

Day ahead and intraday optimization is one of the most valuable forms of flexibility. Axle provides

wholesale optimization, reporting back positions daily to your trading team. In most geographies,

participating in wholesale markets requires a supply license (i.e. a BRP role).

The base unit of participation in wholesale markets is the portfolio of all assets in a given

geography. In order to aid trading, we provide demand forecasts along with an estimate of flexibility,

from which we calculate optimal positions based upon day ahead and intraday prices.

The base unit of participation in wholesale markets is the portfolio of all assets in a given

geography. In order to aid trading, we provide demand forecasts along with an estimate of flexibility,

from which we calculate optimal positions based upon day ahead and intraday prices.

Bidding

Axle bids your assets into the selection of flexibility markets that meet your commercial and technical

needs. We optimize across markets to maximise value.

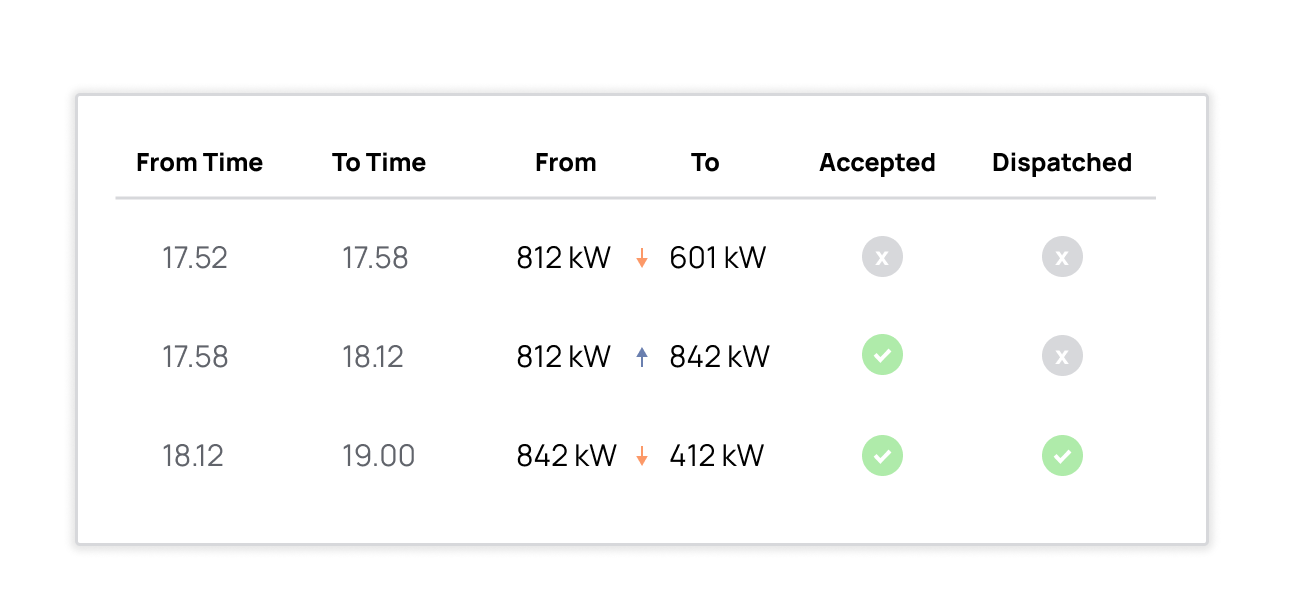

We believe that transparency around trading strategy is an important element of our partnerships. Equally important is

the experience of the asset owners, typically your end customers.

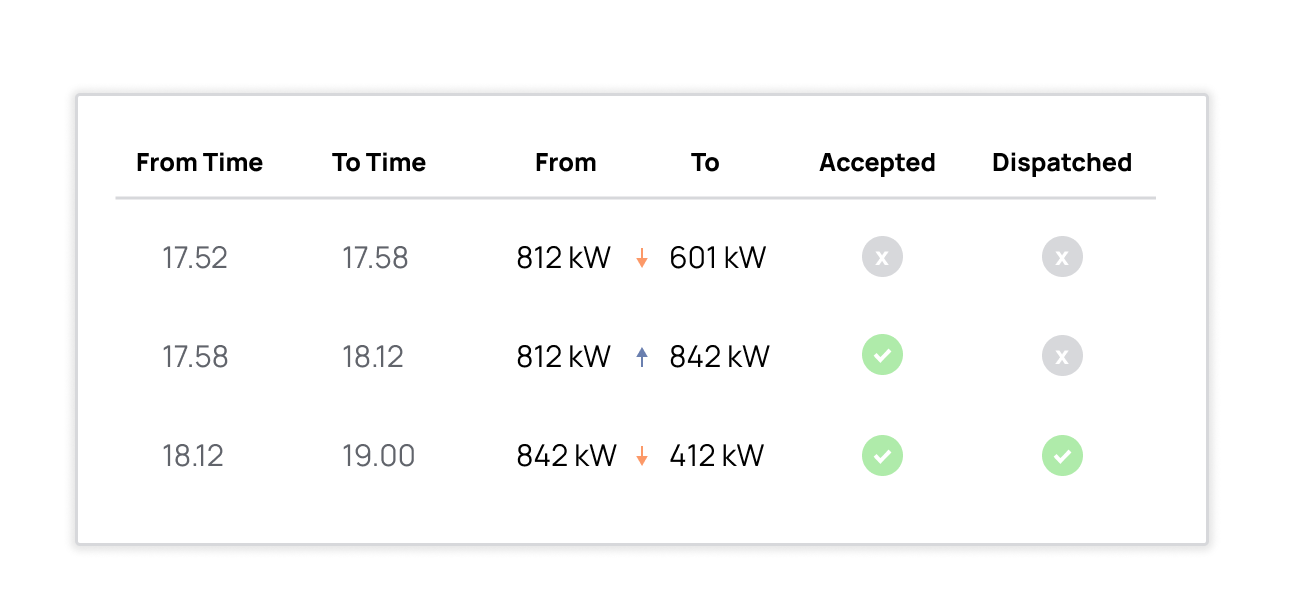

You can monitor the bids and dispatches of your assets from your account Dashboard.

Dispatch

Axle co-ordinates the dispatch of your assets via webhooks you provide. This is an automated process.

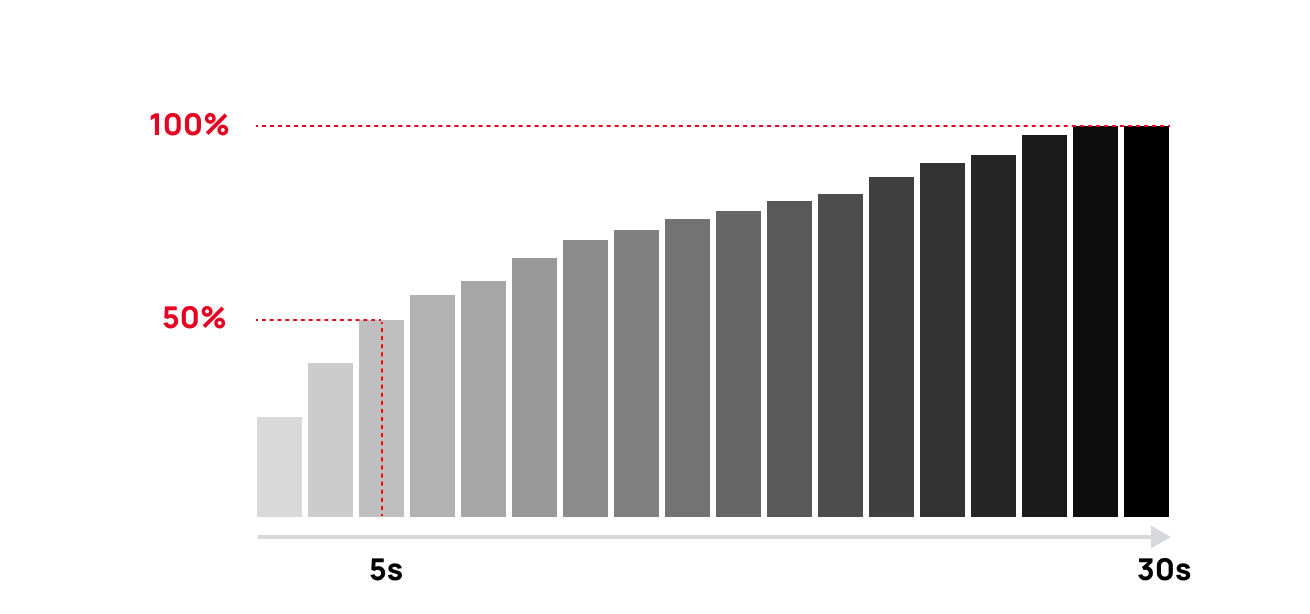

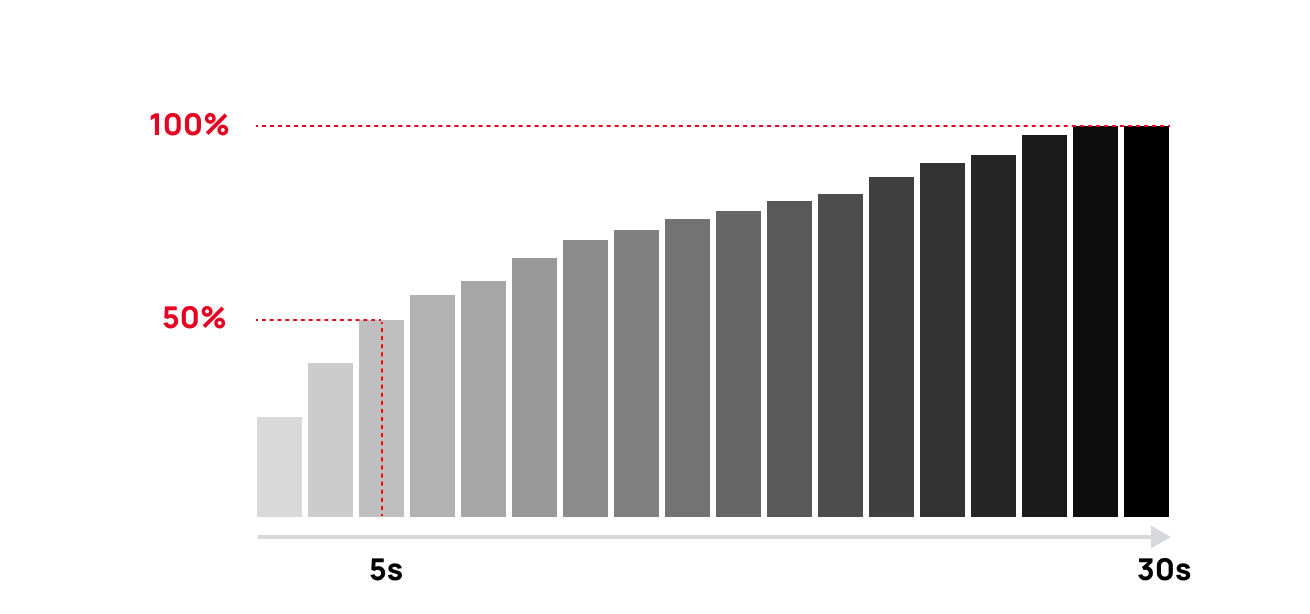

We collect information on the reliability and latency of dispatch. This feedback allows us to build a more

accurate forecast of the quality and quantity of flexibility available from each portfolio, and ensure that we

hit initiation and full activation targets.